Why Tokenize with ABE?

Tokenization is the largest upgrade in the history of capital markets. In addition to outperforming current market infrastructure, blockchain tokenization enables new forms of trading and asset management

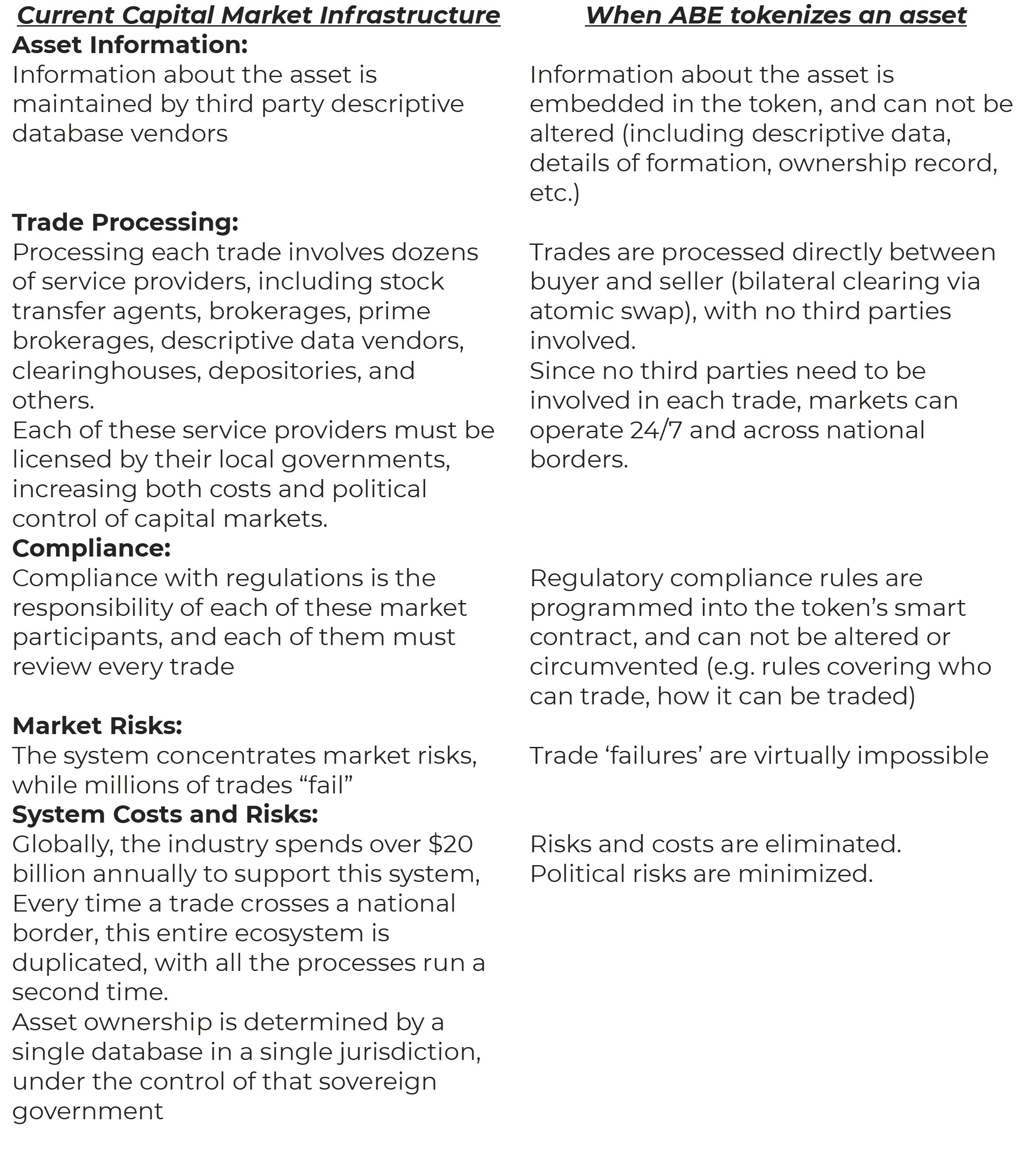

Tokenization Improves Market Functions, and Enables 24/7 Global Markets

Tokenization enables new forms of trading and asset management

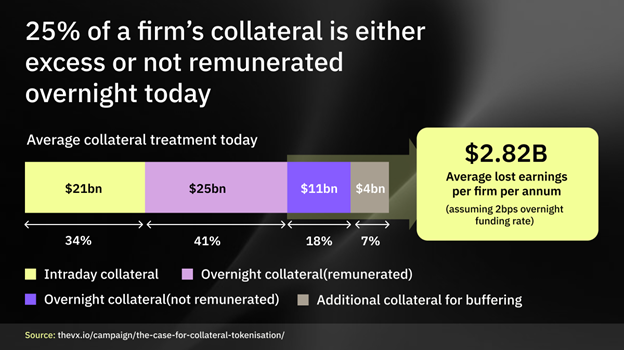

Today, trillions of dollars in collateral are parked in idle, over-posted, or trapped overnight, when they could be working 24/7, around the world. The moment the asset is tokenized, all this changes, and the asset can be part of an onchain real-time collateral mobility system.

The Problem:

The average bank or brokerage firm manages about $74B in collateral, yet:

25% sits excess or unremunerated overnight

70% of firms struggle with delivery

Operating costs can reach 57% of a trade

The result is predictable: delays, failure to optimized sec-lending, time-delays from extended settlements, over-reliance on third-party vendors, and buffers. The current antiquated system locks up capital, and makes banks and brokerages forfeit sizable yield revenue.

The Solution:

Tokenizing the asset, and managing it as onchain collateral changes everything. With the real-time trade settlement that only blockchain can enable, these assets can be financed, reused, and optimized in real time. The impact—reduce excess postings, improve balance-sheet efficiency, increase securities lending revenue, while decreasing portfolio risks. Blockchain-based real-time settlement enables intraday repo and lending, mobilizes collateral 24/7, and empowers portfolio risk management with precision and certainty.

Why ABE?

Companies register once on ABE’s Tier 1 Licensed Exchange regulated by the ADGM, UAE

Trade globally in 50+ countries representing 3 billion investors

Asset classes traded in both public and private markets

Trust is your most valuable asset

Protect your reputation and pave the way for the mass adoption of digital assets with Impenetrable Custody — the only technology that enables institutions to support digital assets that are 100% theft-proof.

Impenetrable Custody

To make digital assets theft-proof, we created a system that protects your assets with no digital input, no internet connection, and access to limited solely to the owner.

What impenetrable makes possible

A) Wallets. Our comprehensive wallet management infrastructure lets both your institutional and retail clients easily deposit, withdraw, and manage their digital assets

B) Policy Engine. Set guardrails for any procedure or workflow. Our granular policy engine aligns with any internal compliance requirements and global regulations.

C) Impenetrable Tokenization. Handle the full tokenization lifecycle of any token type with all operations, from minting to distribution, signed and made tamper-proof by our Impenetrable Custody solution.

D) Impenetrable Staking. Stake assets while ensuring they never leave the Impenetrable Vault. Delegate assets for staking across all significant blockchain protocols.

E) DeFi. Engage in DeFi activities, including trading and lending. Our infrastructure can interact with any smart contract across all blockchain protocols, including EVMs.

F) Exchange Integration. Buy, sell, and swap directly to ABE Global and the other largest exchanges and liquidity providers from ABE’s platform, similar to what you currently offer on traditional assets.

Always be compliant

Comply with global regulations

including OCC, MiCA, and BaFin.

We offer third-party AML and KYC

solutions, as well as crypto balance

attestation on digital assets.

Be ready for whatever is next

Support any digital asset and smart

contract with zero time to new business

through our unique Universal Asset

Engine and ensure scalability for

evolving blockchain demands.

Self-custody storage methods in the digital asset market

Impenetrable Custody. Never connected to the internet. 100% theft-proof. No digital input.

Cold Custody. Partially connected to the internet (e.g., Cloud HSM, air-gapped).

Warm Custody. Always connected to the internet (e.g., Multisig, MPC)

Access the largest insurance

Get access to up to $1B in insurance

per Impenetrable Vault, exclusively

granted to ABE customers. This

reflects the utmost confidence in our

cutting-edge technology.

Looking for MPC for your daily operations?

Build your on-chain offering with our unique

MPC-based end-to-end solutions, featuring

our patented Unlimited MPC (uMPC)

technology; it’s more secure and the fastest on the market.